Redding Financial Advisors

We’re here to help you achieve your financial goals. Reach out to us for personalized advice and expert solutions tailored to your needs.

We are accepting clients with a minimum of $500,000 in investable assets at this time.

Contact UsGet in Touch with Us

Redding Financial Advisor in Redding, CA

Our local expertise ensures personalized financial strategies tailored to your unique needs.

About Redding Financial Advisors

Are you seeking a financial advisor in Redding, CA? Are you interested in receiving a complimentary review of your current portfolio or retirement strategy? Your priorities matter most to me. My goal is to understand what’s important to you, and together, we’ll work towards ensuring you’re on the right path to achieve your financial objectives.

A native of Redding, CA, I am deeply involved in my community. I devote my time to coaching various youth sports, including High School football, and recently served as the Linebacker coach for Foothill High football. Additionally, I volunteered at the Shriner’s Hospital for six years, where I helped organize the oldest college all-star game in the nation. I am proud to say that I have organized events that have helped raise over $500,000 for schools, charities, and to fight hunger in Shasta County. As the former President of The Redding Sundial Kiwanis, I was able to co-create a Pantry Program that currently feeds over 350 kids a week in Redding.

Outside of my community involvement, I cherish spending time with my children. My son, JT, is a Senior at Foothill High School, where he plays football on my team, and he enjoys video games and watching the Minnesota Vikings. Meanwhile, my daughter, Jenae, is passionate about her art and is currently working on becoming a Tattoo artist. Both kids are outstanding students, maintaining impressive 4.0+ GPAs.

As a financial advisor at Redding Financial Advisors, I am passionate about assisting clients with goal setting, wealth management, and estate planning. My focus lies in intergenerational wealth, aiming to benefit your future generations through our partnership. Whether you’re retired, facing life-changing news, or have recently received an inheritance and seek guidance, I am here to help ensure your financial security.

I thrive on the opportunity to assist clients in creating retirement strategies for long-term success. Let’s collaborate to develop a tailored plan that aligns with your aspirations and objectives.

If you’re in need of assistance with your investment goals, please don’t hesitate to contact and me or my team. We’re here to support you every step of the way.

Secure Your Financial Future Today

Trust us to guide you through every step of your financial journey with confidence.

Financial Services Tailored to You

Explore our range of expert services designed to meet your unique financial needs and help you achieve your goals with confidence.

Financial Planning

In life, there are many decisions that can have long-lasting consequences for the rest of your life. Financial planning is an essential service that provides individuals and families with the necessary framework to navigate their financial journey effectively. By assessing current financial situations, setting achievable goals, and implementing strategies tailored to individual needs, financial planning helps secure financial futures, manage risks, and optimize resources. From retirement planning to investment management, tax optimization, and estate planning, comprehensive financial planning empowers individuals to make informed decisions, pursue their short and long-term objectives, and navigate life’s uncertainties with confidence.

One of the biggest decisions you’ll ever make is choosing the right financial advisor. It can feel overwhelming with all of the different options available to you. You’re looking for a financial advisor who is highly qualified, familiar with your goals, follows the ethical standards of putting their client’s interests above themselves, and really is involved in the local community. Redding Financial Advisors is ready to meet with you and help with your financial goals.

Investment Strategies

Has anybody every “stress-tested” your portfolio? Have you ever heard the term, “Set it and forget it”? Well, that’s NOT what you want when you work with a financial advisor. You want an advisor who stress tests your financial strategy quarterly to make sure you are on track for your goals. Our advisors all spend time looking at the investments, the market, and testing your strategy against what’s happening currently. And while you don’t want an advisor who just tinkers or creates complicated investment portfolios, it’s important to have someone who is watching your money and making changes accordingly with market conditions and the current economy, both nationally and globally.

Wealth Management

When choosing a financial advisor, it’s important to have one that’s focus is on your goals and your wants, but also to help you transfer any remaining wealth to the next generation. This takes a lot of extra planning. Our advisors work with trust attorneys, CPA’s, and other professionals to make sure that your plan is appropriate from beginning to end. Intergenerational wealth planning stands as a vital cornerstone in securing a family’s financial legacy across generations. By carefully considering the transfer of assets, values, and knowledge from one generation to the next, this approach ensures the preservation and growth of wealth while fostering familial unity and prosperity. Intergenerational wealth planning goes beyond mere financial considerations, encompassing education, communication, and the transmission of values and life lessons. Through strategic wealth transfer mechanisms such as trusts, estate planning, and charitable giving, families can pass down not only monetary assets but also a sense of responsibility, resilience, and purpose. This holistic approach fosters enduring financial stability, empowers future generations to build upon past successes, and strengthens the familial bond, creating a legacy that transcends monetary wealth alone. Redding Finanical Advisors strives to pass your legacy on.

Navigate Your Financial Journey with Us

Let’s work together to build a secure and prosperous future right here in Redding.

Podcasts

Did you know that Chris has his own Podcast? Tune in to The Healthy Wealth Experience for expert insights, market analysis, and the latest trends in finance, designed to help you make informed decisions and stay ahead in the financial world.

EP #21: Meeting Clients Where They Are: The Lead Nurturing Revolution with Joey Gartin

In this game-changing episode of The Healthy Wealth Experience, host Chris Hall sits down with digital marketing expert Joey Gartin from Web Driven to expose the #1 mistake that's killing most businesses' marke...

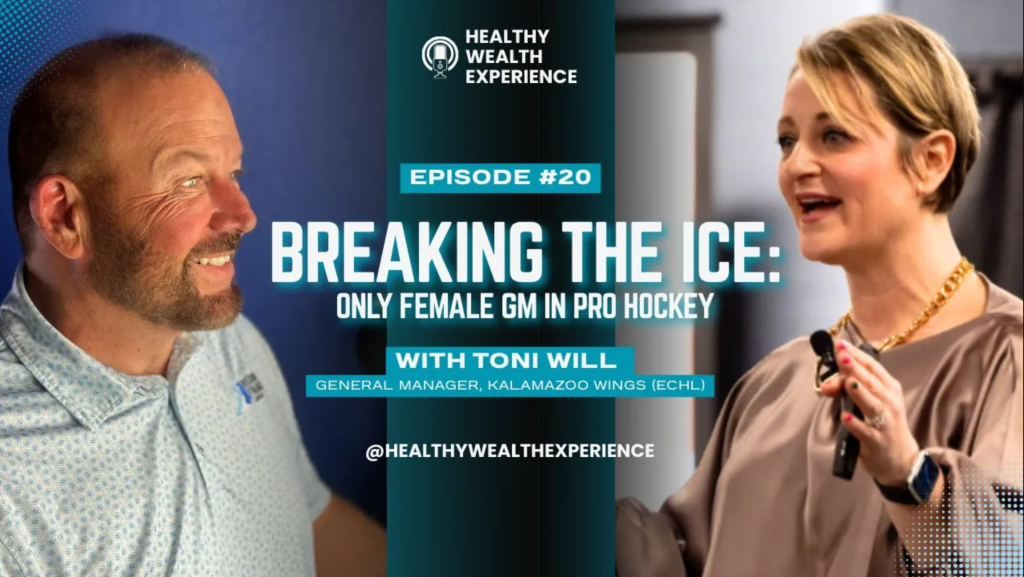

EP #20: Breaking the Ice: Why Sobriety Became My Secret Weapon in Pro Hockey | Toni Will

Toni Will is the only female General Manager in professional hockey, leading the Kalamazoo Wings in the ECHL for over 11 years. She’s also the only female Governor on the ECHL Board, breaking through to serve...

EP #19: Dr. Eva Selhub on Stress, Inflammation, and the Mind-Body Connection

Discover proven strategies to reduce chronic inflammation and manage stress from Harvard Medical School instructor Dr. Eva Selhub. Learn natural anti-inflammatory methods, breathing techniques for anxiety reli...

Maximize Your Financial Potential

Discover strategies and insights designed to help you achieve lasting financial success.

FAQ

Find answers to the most common questions about our services, financial strategies, and how we can help you secure a prosperous future.

The average fee is 1.5% of assets for money management. You can find online brokerage houses that will do it for .5% or less and some money managers will charge 2-3% of assets under management, plus 10% of profits. These are usually referred to as hedge fund managers. If you using a local financial advisor, you should expect to pay between 1-2%.

First, you can find online reviews of local financial advisors by doing a simple Google search. After you found that one that looks best to you, we recommend going in to see them for an interview. You and the advisor are both interviewing each other to see if it’s a good fit. If an advisor starts talking about investments and returns out of the gate, we suggest looking elsewhere. Investments are a side-effect of a sound financial strategy. As a rule, you shouldn’t talk about investments until the advisor has taken the time to get to know you and your goals. You may want to also check with brokercheck.org to make sure they are in good standing.

Almost all financial advisors will meet and talk with you about your financial goals for free. This is a great opportunity to get to know the advisor and see if they are right for you. If you are with a robo-advisor or an online brokerage firm, you can usually talk to someone at the 1-800 number for free. However, most people with high net worth have complicated financial planning, which could cost them thousands of dollars over time without good advice.

Just like all industries, financial management has no shortage of scams and theft. However, there are great ways to avoid those types of instances. For one, working with an advisor that is under supervision by a large company. Some independent advisors work alone and only have a bare minimum of supervision. Larger firms have extensive supervision and protocols in place to ensure that nothing outside of predetermined guidelines happens. With local advisors, it’s always great to check their online reviews.

Not everyone needs a financial advisor. Here is a good list of people that could use some professional advice:

* If you are nearing retirement and want to make sure you are on the right track.

- You have recently inherited some money and you would like advice on how to best maximize it’s effect on your life.

- If you have recently gotten married and you want to arrange your finances and strategies as a couple.

- You are recently divorced and you need to rearrange your finances for a single retirement with the assets that you kept.

- Your mom and/or dad are getting older and they may need help managing their finances, monetary needs, estate planning, etc.

- If you know that you need to save for retirement, but hate the stock market and investing and you need a partner to guide you.

- I’m in retirement and I have an advisor, but I never hear from him/her and I’m not sure if my investments are important to them. You have recently been awarded a large settlement, but don’t want it to be structured (annuitized).

Reasons you would need or want a financial advisor can be many. If you have complicated issues with tax planning, investments, businesses, estate planning, charitable contributions, etc., then you would probably want to employ a financial advisor. If you are looking for a partner to work with you throughout the years, you may also want to employ a financial advisor. If you’re just starting out and have minimal complications or investments, you may want to decided to go it alone. If you do go it alone, we ask th

There’s no such thing as a free lunch, but there are versions of it. If you are with an online brokerage firm, you can often talk to a licensed advisor for free. However, many will find their advice to be general and lacking any individuality. If you’re looking for personal advice on your unique situation, it’s a good idea to look for a financial advisor who sees clients one on one.

The fees that financial advisors charger are usually based on complicated financial planning and advising. If this is not the case for you and you are just getting started out, you may not want to employ a financial advisor at this time. Most financial advisors have a minimum requirement of net worth.

Although there are many book sellers out there that say they are not worth it, we would give an emphatic yes. Vanguard, the king of no-cost, self-service management agrees that advisors are worth every penny. While most advisors charge around 1% of assets under management, Vanguard found that “advisors can add value, or alpha, by providing relationship-oriented services – such as cogent wealth management via financial planning, behavioral coaching, and guidance – as a primary objective of the value proposition.” In their famous study called Advisor’s Alpha, they found that, on average, an investor would get an additional 3% annual return when using an active advisor.

Although not impossible, financial advisors can rarely take your money. As long as the accounts are opened in your name only, the assets will be independent of your advisor. In other words, never open a Joint account with both your name and your advisor’s name on it. A good rule of thumb is to never make out checks to the advisor or invest in his own brand of investment club. As with all things, going with a larger company can nearly eliminate all of these potential problems with a fair amount of supervision.

Someone meeting with a financial advisor would get more out of their meeting if they knew ahead of time what their goals are. You may have both short term and long term goals and you may want to talk about multiple goals. You should have an idea on what those are before you arrive. When it comes to retirement, here are some questions you can ask yourself to become better prepared for your meeting: At what age do you want to retire? How much money would you spend in retirement each month to live comfortably? How much have you saved so far (provide statements and documents)? Do you have a pension and/or social security? If so, what are those numbers at different points in time (provide statements and documents)? What is your current budget for necessities, as well as your fun-money budget? How much are you investing now and how much could you invest at this time?

Contact Us

We’re here to assist you with personalized financial guidance—reach out to us today to start building a brighter financial future.

Send A Message

Hours

| Sunday | Closed |

| Monday | 8AM–4PM |

| Tuesday | 8AM–4PM |

| Wednesday | 8AM–11:30 AM and 1:30PM to 4PM |

| Thursday | 8AM–4PM |

| Friday | By Appointment Only |

| Saturday | Closed |